Kaye's Monday Mindset: Master Your Inner Dialogue

There is a conversation happening in your life all day long — and it’s the one you’re having with yourself. That inner dialogue shapes your confidence, your courage, and even how you respond when...

There is a conversation happening in your life all day long — and it’s the one you’re having with yourself. That inner dialogue shapes your confidence, your courage, and even how you respond when...

The information in this column is not intended as legal advice but to provide a general understanding of the law. Any readers with a legal problem, including those whose questions...

We live in a world that pulls our attention in a hundred different directions — emails, texts, calendars, to-do lists, and worries about tomorrow. But the truth is, most of the...

SHSU professor reflects on service, community, and fifteen years of volunteering at Journey Through Bethlehem A Professor Who Finds Joy in Bethlehem Huntsville knows Dr. Darren...

Hundreds expected as more than 30 churches unite to bring the Luke 2 story to life at the Walker County Fairgrounds A Longstanding Community Tradition Journey Through Bethlehem,...

Local real estate veteran discusses price drops, buyer advantages and neighborhood updates A Trusted Realtor With Decades of Experience Real estate professional Terri Coleman, who...

A Warm Return to Good Morning Huntsville Reverend Jeff Powers of Christ the King Methodist Church returned to Good Morning Huntsville for a second time to share updates on...

Ministry has supported more than 400 families; event set for December 12 at Elkins Lake Club House Growing Ministry Rooted in Personal and Community Experience HUNTSVILLE, Texas —...

Since joining Sam Houston State University in 2006, Clinical Assistant Professor Courtney Wallace has dedicated her career to advancing student engagement, community health and...

The information in this column is not intended as legal advice but to provide a general understanding of the law. Any readers with a legal problem, including those whose questions...

If there’s one thing that quietly holds people back — in work, in relationships, in dreams — it’s comfort. Comfort feels safe… but it keeps us small. Robin Sharma reminds us that...

The information in this column is not intended as legal advice but to provide a general understanding of the law. Any readers with a legal problem, including those whose questions...

$40 million facility will transform collaborative teaching and hands-on learning for future Bearkats. HUNTSVILLE, TEXAS–– Sam Houston State University (SHSU) has officially broken...

Holiday concert fills Huntsville High School Performing Arts Center with music, generosity, and hope. On Saturday, November 15, the Huntsville community gathered for an evening of...

New interdisciplinary effort aims to advance ethical, data-driven AI tools for medical education, research and patient care. HUNTSVILLE, TEXAS–– The Sam Houston State University...

If there’s one truth I see over and over — in classrooms, teams, families, and even in my own life — it’s this: your habits shape your future long before you ever see the results....

The Magic of Holiday Jewelry Gifting Elliott’s Jewelers | Huntsville–Walker County Why Jewelry Is the Heart of Holiday Traditions A Sparkle That Says “You’re Loved” A Gift That...

Legal and financial steps families and businesses should review before the new year. The information in this column is not intended as legal advice but to provide a general...

SAAFE House director coordinates community donations, meal distribution for Huntsville residents in need HUNTSVILLE, Texas — As Thanksgiving approaches, SAAFE House Executive...

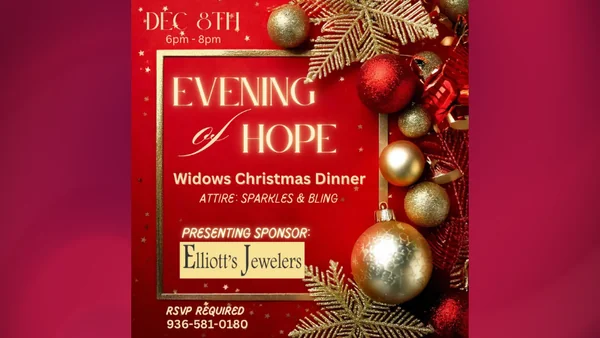

Adriane Hunter expands annual Christmas gathering as demand grows HUNTSVILLE, Texas — What began as a small gathering for widows facing the holidays alone has grown into one of...

2026 WineQuest – Boots, Bottles & Barrels Benefiting Huntsville Rotary Charities, Inc. Event Date: Saturday, April 11, 2026Time: 7:00 PM – 10:00 PMLocation: W.S. Gibbs Conference CenterAddress:...

Find out more